Florida/US Personal Use Property. How Should You Own It?

Properties in many areas of United States, including Florida, are still considered undervalued with the market still recovering after the 2008 collapse. In the 12 month period ending March 31, 2017, Canadians purchased $19 billion worth of US properties compared to $8.9 billion in the 12 months prior, with Florida being the top destination for those buyers.

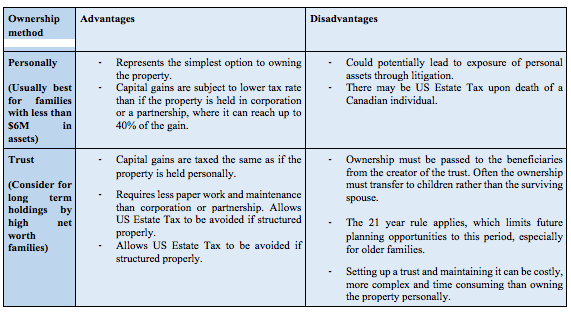

There are several issues to take into consideration when a Canadian buyer considers how to take title of their US property. There are a number of options including personal, trust, partnership and corporate ownership. We usually recommend Canadians should hold a personal use US property either personally or through a trust.

Personal Ownership

a) Income tax

If the property is sold, the tax payer is subject to 15% withholding tax of the gross sales proceeds, as well as the filing of US tax return to report the gain on the sale, if any. This withholding tax is then applied against the balance of capital gain tax payable and any refund is returned. Since Canadians are required to report their worldwide income, the gain on the sale of the U.S. property must also be included when filing the Canadian income tax return. Taxes paid in U.S. can generally be claimed as a credit to reduce the tax payable on the gain in Canada to avoid double taxation.

b) Estate Tax

One of the main issues that Canadians have to consider is the US Estate Tax, which applies upon the death of the tax payer and can reach up to 40% of the US property value. No tax applies if the value of tax payer’s worldwide assets is less than $5.49M. Canada however has signed a treaty with the US that includes a Unified Credit exemption. This exemption allows for non-residents to exempt a pro-rated portion of their properties from the US estate tax. Additionally, the treaty also provides a Martial Credit which can be used if the US assets are passed to the spouse on death. This credit equals the lesser of the unified credit and the amount of the estate tax.

If personal ownership is the best route, you still need to carefully consider whether ownership should be taken by one spouse or both. Sometimes the lower net worth spouse can take ownership in order to come under the world wide asset value test of $5.49M.

The below table shows the different scenarios that can apply if you own a $1M US property personally should death occurs in 2017:

As can be seen above, US estate starts to apply if the value of worldwide assets is between $5.49M - $10M and you are not married and if the value of the worldwide assets exceeds the $10M mark. There are strategies that can be used to lower the impact of US estate tax. One of those strategies is to buy life insurance. Life insurance can be used to fund the US estate tax liability. In order to avoid having the value of the property or the death benefit being added to the deceased worldwide assets value and reduce the available pro-rated credits, the ownership of the property should be transferred to a trust or another person. Life insurance proceeds are also not subject to US estate tax.

Trust Ownership

a) Income tax

Same implications as explained above for individuals selling real estate.

b) Estate tax

Owning the property through a Canadian trust can help avoid US estate tax as the individual does not own the property. To accomplish this, the trust should purchase the property directly after having the funds transferred to it before the purchase. The individual should be prepared to give up both ownership and control of the property to the trust and therefore this method is recommended to individuals only if they wish to involve their spouse/ family in the ownership of the property, if the value of the property does not make up a significant portion of the individual’s net worth and for younger families due to the 21 year rule that limits future planning opportunities as the property is deemed to be disposed of at market value after 21 years, which could trigger a capital gain.